3 Reasons Why Crypto is Breaking Out and the Rally Might Have Legs

[ad_1]

The bullish breakout in crypto that started last week has seen investors beam with hope for a sustainable recovery. Bitcoin (BTC) and other cryptocurrencies struggled throughout 2022 amid internal and external uncertain events.

The crypto market’s initial pullback between November 2021 and April 2022 did not worry investors much, as it was seen as a natural retracement from all-time highs. However, the collapse of TerraUSD (UST) in May, a once thriving algorithmic stablecoin from the Terra Luna (LUNA) ecosystem, changed the course of the market from a pullback to a full-blown bear run.

Several companies exposed to UST could not survive the crash, including Three Arrows Capital, Celsius Network and Voyager. Many people lost their life savings, setting crypto years back.

Fast forward to November 2022, another crypto giant filed for bankruptcy amid a disastrous collapse. Sam Bankman-Fried’s FTX exchange faced a liquidity crunch after reports of an unhealthy financial relationship with its sister company Alameda Research.

Crypto turned bloody again, with Bitcoin price plunging to November 2020 levels at $15,466. Ethereum, the second-largest crypto, slipped below support at $1,100, hitting a four-month low of $1,075.

Crypto experts believe that 2023 is unlikely to be the year we see a massive bullish turnaround, with some predicting the crypto winter to last until December. However, there are some key factors behind the spike in crypto prices, especially among altcoins, since last week.

Easing Inflation Drives Investors Back to Crypto and Riskier Assets

Bitcoin price blasted above $17,000 on Monday, reaching a three-week high in what market watchers believe was a response by investors to signs of easing inflation. Altcoins also posted significant gains, with Ethereum increasing by over 4%.

The crypto market’s upward trend occurred just 24 hours after the Federal Reserve Bank of New York announced an anticipated inflation expectation of 5% for December, which was lower than the previously predicted 5.2%.

According to CoinDesk, the 5% reading indicates a decrease for the second month in a row, and the most recent reading is the lowest it has been since July 2021. The actions taken by the Federal Reserve to control inflation are still affecting the prices of both Bitcoin and ether.

Investors are banking on the expectation of declining inflation as a sign of a sustainable market recovery, which explains a spike in long bets on both ETH and BTC. The Fed also expects interest rates to be average around 5%.

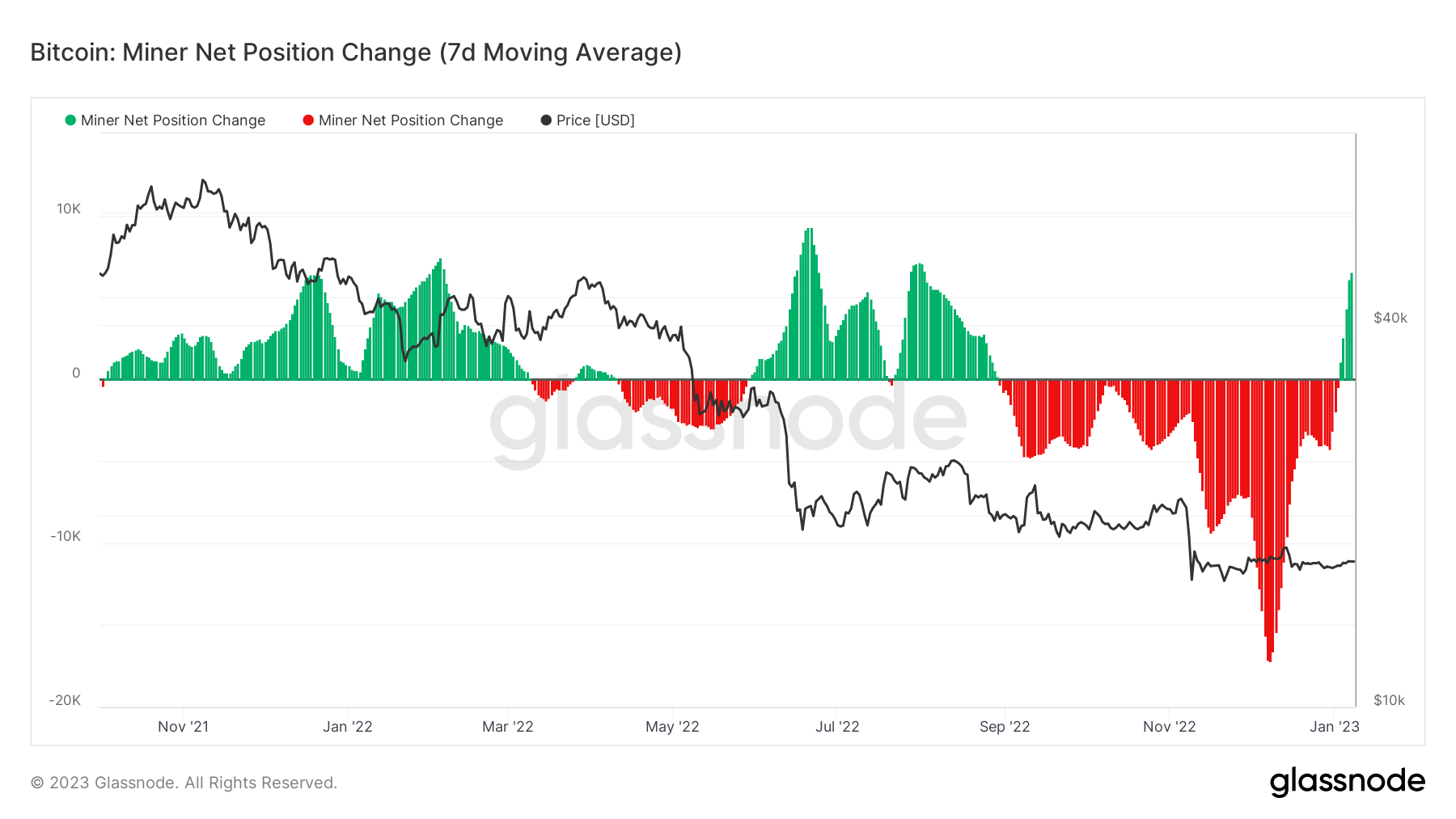

Bitcoin Miners Break Multi-Month Selling Streak, As Crypto Prices Jump

Bitcoin miners were forced to continue divesting themselves of their Bitcoin holdings in 2022 as crypto prices broke out into the green. The implosion of FTX made matters worse for miners, forcing many to shut down their rigs due to ‘miner capitulation.’

William Clemente, the founder of Reflexivity, a crypto research platform, opines, “the heavy sell pressure from Bitcoin miners that has barraged the market for the last 4 months has finally subsided for now.”

On-chain data from Glassnode, one of the leading crypto analytics platforms, confirm insight into miner capitulation easing over a 30-day net position. Moreover, Bitcoin miner reserves hit a monthly high on January 8.

Extreme Fear Drives Crypto Price Recovery

Veteran investors believe you should buy when everyone is reeling from seemingly unending losses. However, this statement cannot be taken lightly, considering the havoc investors ensured in 2022.

According to Alternative.me, a platform that presents the Crypto Fear & Greed Index, the general market sentiment dipped back to the top of the most bearish bracket last weekend. The index holds at 26, roughly where it has been over the last month.

Despite the bullish move in crypto prices, altcoin volume remains relatively low based on-chain data from Santiment. Therefore, for the market to keep the uptrend intact, it would need support from investors, particularly the whales. Another report from CryptoQuant revealed that the whale selling pressure dropped in December, hinting at a “positive effect on market sentiment” over the coming months.

Altcoins To Consider for Quicker Returns

The uptick in crypto prices points to a possible market turnaround in 2023, but that is not guaranteed if 2022 is anything to go by. Therefore, investors must make deliberate decisions as they diversify their crypto portfolios.

New and upcoming crypto projects could offer a faster escape from the bear market run. The assets listed here are in their presales and performing exceptionally well ahead of their first exchange listings.

Dash 2 Trade (D2T) Is Listing on Gate.io

Learn2Trade, a team of veteran trading experts, is thrilled to introduce a revolutionary cryptocurrency platform poised to change how people view and manage their crypto portfolios. Dash 2 Trade provides users with unparalleled access to world-class crypto analytics and social trading tools.

The platform is packed with features and services for traders to explore as they navigate the ever-evolving cryptocurrency market. From timely trading signals to social sentiment and on-chain analysis, Dash 2 Trade makes it easy to spot trending coins and stay ahead of the curve.

But that’s not all – Dash 2 Trade also includes a trading strategy builder to help investors improve their skills and share ideas with others. Plus, users can access a presale dashboard to discover new projects entering the market before they launch. Get ready to take your crypto trading to the next level with Dash 2 Trade.

Dash 2 Trade presale ends in less than 24 hours, as it makes its first debut as a tradable asset on Gate.io. Both teams confirmed the listing, with Gate.io welcoming the new assets with an Initial Free Offering and an airdrop worth $120,000.

Visit Dash 2 Trade Now.

FightOut (FGHT): Breaking Barriers in The Fitness Industry

This is a revolutionary cryptocurrency platform that is revolutionizing the way we think about fitness. FightOut combines the power of a fitness app and a chain of gyms to incentivize users to lead a healthy lifestyle.

Beyond earning rewards for completing workout tasks and challenges, users have the opportunity to thrive within a vibrant community. The platform operates within a tokenized economy, where users can earn FGHT tokens for completing M2E tasks.

FightOut is taking things to the next level by introducing Web3 solutions, where users can create accounts and mint their own digital NFT avatars to use in the metaverse.

This cutting-edge technology has the potential to revolutionize the fitness economy, making it more accessible and interactive than ever before. Join the FightOut movement and take control of your health.

FightOut’s presale raises $2.81 million as investors rush to capitalize on a 50% bonus which expires as soon as the first $5 million is raised.

Visit FightOut Now

C+Charge (CCHG): Linking EV Drivers To Carbon Credits for The First Time

Using blockchain technology, C+Charge has developed a robust Peer-to-Peer (P2P) payment system for electric vehicle (EV) charging stations. Users will be given individual electronic wallets, which they can use to make payments for EV charging with the C+Charge utility token.

As the number of EVs on our roads increase, the need for more charging stations becomes apparent. Additionally, the EV industry faces the challenge of creating standardization for charging.

C+Charge not only provides access to carbon credits but also offers a seamless payment system for EV charging services for both drivers and charging station operators through the use of its CCHG tokens.

C+Charge presale is selling out fast with $234k raised. The total amount doubled in 24 hours following a single purchase of $100k.

Visit C+Charge Now.

Related Articles:

[ad_2]

Source link