Find Out How Bitcoin Rally Creates 1,500 Millionaires Per Day

[ad_1]

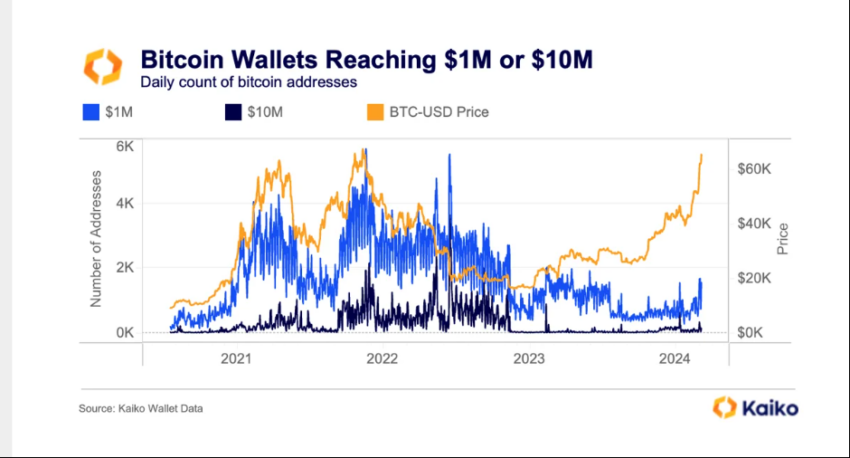

Bitcoin’s (BTC) current rally generates around 1,500 new “millionaire wallets” daily. This revelation comes from Kaiko Research, signaling a significant shift in wealth within the cryptocurrency ecosystem.

These millionaire wallets are digital addresses on the Bitcoin blockchain, storing vast amounts of crypto. While the blockchain’s transparency allows for public viewing of token quantities, owner identities remain concealed. This anonymity shrouds whether individuals or entities control the wallets.

Bitcoin Millionaire Wallets Yet to Reach 2021 Highs

The rise of BTC, with over 70% increase this year, rides on the excitement over US-based spot Bitcoin exchange-traded funds (ETFs). These funds began incorporating cryptocurrency in January.

Despite this surge, the pace of creation of millionaire wallets is slower than in 2021’s bull market. Back then, over 4,000 wallets daily were reaching millionaire status. The peak this year was on March 1, with 1,691 wallets.

Several factors contribute to this tempered growth. Kaiko’s analysis suggests a gradual inflow of fresh capital. Meanwhile, large investors, or “whales,” are seizing the opportunity to profit from the high prices. Furthermore, many choose custodial services over personal wallets for their holdings.

“In 2021, there was a huge influx in capital as all manner as bull sought to benefit from the crypto hype. This time around, whales could be taking a more cautious approach, waiting to see if the gains have legs before investing,” Kaiko Research said.

Read more: Who Owns the Most Bitcoin in 2024?

Interestingly, cryptocurrency is capturing mainstream attention, possibly heralding more investment. Canadian superstar Drake recently shared a clip from Bitcoin bull Michael Saylor with his 146 million followers on his Instagram story. Such endorsements could draw new investors into the crypto fold.

Meanwhile, MicroStrategy added 12,000 BTC to its holdings, an investment of $821.7 million. This purchase brings the firm’s total to 205,000 BTC, valued at over $14.84 billion. Additionally, crypto trader MartyParty noted decreased Bitcoin reserves on central exchanges. Binance’s balance is down to 546,589.20 BTC, whereas Coinbase Pro has 358,787.15 BTC left.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link