FTX Collapse Highlights Need for Independent Reserve Verification

[ad_1]

Binance has ended another week of FUD (fear, uncertainty, doubt) with another report on its proof-of-reserves. But Mazars, the authors of the previous reserves report, has simultaneously distanced itself from the industry.

The exchange giant reportedly commissioned CryptoQuant to look over its bitcoin reserves, following the Mazars report earlier this month. The analytics provider reported that Binance’s BTC customer deposits are 97% collateralized by the exchange’s assets, which increases to 101% when the BTC loaned out to customers is included.

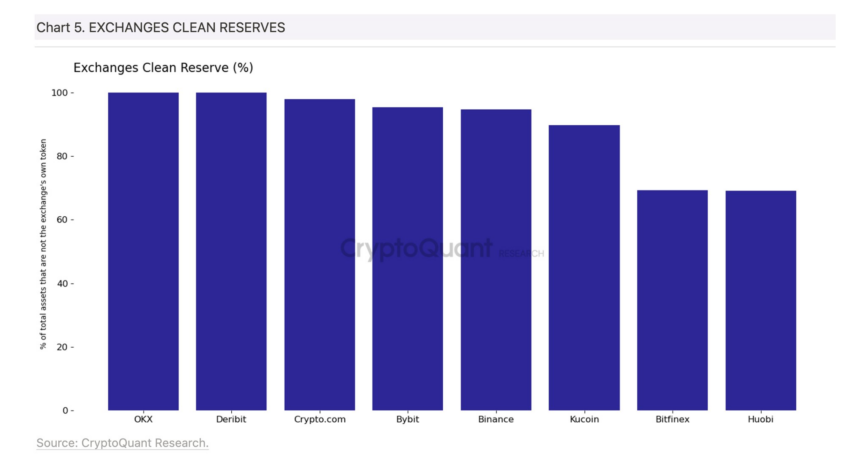

Their investigation also found that, unlike FTX, Binance’s native token (BNB) is not a large share of its reserves. Like the Mazars report before, no other coins or tokens were considered.

Importantly, CryptoQuant stated that Binance was not facing an FTX scenario. A welcome sign for users of the exchange and the wider crypto ecosystem.

Mazars Distances Itself From Crypto

On Friday, Mazars distanced itself from the cryptocurrency industry. According to Bloomberg, the auditor suspended “all work for crypto clients.” The move followed the release of a controversial report about Binance last week. In response to the backlash, Mazars removed the report from its website.

Whilst widely understood to be an audit – with no thanks to CZ himself – the report was actually an AUP, or “agreed-upon procedure”. Essentially, a less rigorous investigation into their reserves. Mazars said in an emailed statement that “this is due to concerns regarding the way these reports are understood by the public.”

Mazars has also disassociated itself from its work with Kucoin and Crypto.com, as neither report can now be found on its website. A representative from Crypto.com stated that the company plans to “engage with reputable audit firms in 2023.”

According to Forbes, the relatively minor audit firm Armanino also confirmed it would no longer be working with crypto clients. Armanino carries a reputation among the crypto community for auditing the collapsed exchange FTX.

Who Audits Crypto Now?

Mazars and Armanino both engaged with some of the biggest cryptocurrency companies, such as FTX, Binance, Nexo, Kraken, and Crypto.com. However, with these companies no longer working with the sector, it raises concerns about who will conduct independent audits.

Armanino and Prager Metis CPAs both carry accusations of “willful blindness” to the “racketeering” with the disgraced exchange in a lawsuit filed last month.

Recent controversy will do little to dissuade consumers from the need for independent verification of reserves, which have exploded since the collapse of FTX.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

[ad_2]

Source link

SCOOP: Mazars is pausing all work for crypto clients, including proof of reserves reports.

SCOOP: Mazars is pausing all work for crypto clients, including proof of reserves reports.