JPMorgan Brings Blockchain to India, Predicts $45,000 for Bitcoin

[ad_1]

JPMorgan has partnered with Indian banks to settle dollar transactions using the blockchain. Meanwhile, the bank also believes there will be a surge in Bitcoin (BTC) demand as the halving event is less than a year away.

Publically, JPMorgan has been one of the biggest critics of Bitcoin. But, the bank has been utilizing blockchain technology and serving its clients with related products.

JPMorgan Aims to Bring 24/7 Transactions Settlement With Blockchain

According to Bloomberg, JPMorgan has partnered with six Indian banks for a blockchain-based solution to settle interbank dollar transactions. The pilot project that went live today will utilize JPMorgan’s Onyx platform.

The American bank launched the Onyx platform in 2020.

The traditional system takes a few hours for the settlement of transactions. Also, the traditional finance system takes a break during weekends and public holidays. But blockchain technologies allow transactions to be facilitated 24/7.

Kaustubh Kulkarni, Vice Chairman for the Asia Pacific region at JPMorgan, said:

“By leveraging blockchain technology to facilitate transactions on a 24×7 basis, processing is instantaneous and enables GIFT City banks to support their own time-zone and operating hours,”

GIFT stands for Gujarat International Finance Tec-City, a city being built with the vision of becoming a trade hub.

Bitcoin at $45,000: JPMorgan

According to Barron’s, JPMorgan analysts believe that the surge in gold’s price, at around $2,000/ounce, may result in strong demand for Bitcoin. The analysts anticipate BTC hitting the $45,000 price zone.

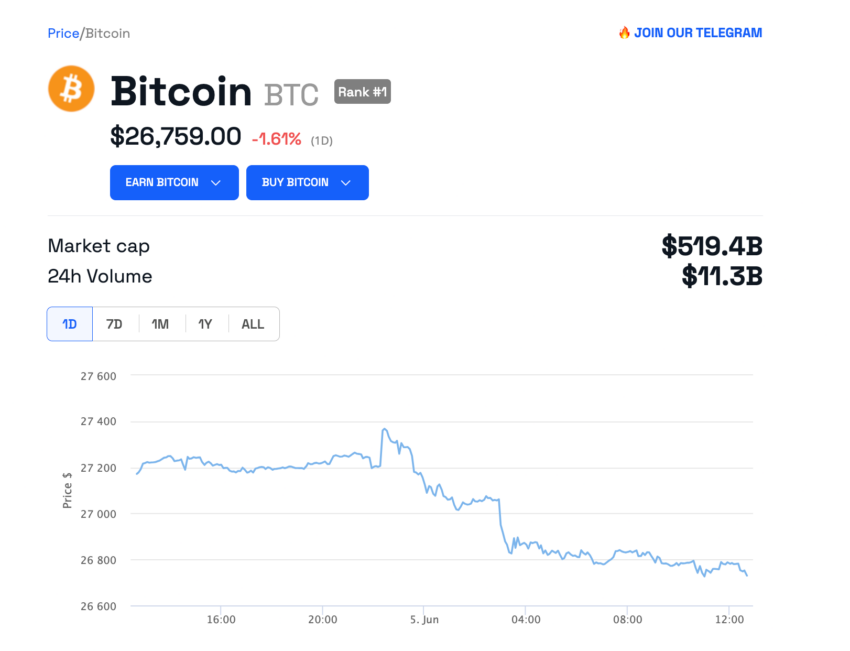

This is due to the fact that Bitcoin and gold are considered safe havens and a hedge against inflation during times of financial crisis. As of writing, the price of Bitcoin is at $26,759, down by 1.61% in the past 24 hours.

Read our Learn article on how inflation can impact you.

Furthermore, JPMorgan believes that the next halving event might act as another catalyst for a Bitcoin rally. During halving, the block rewards are reduced by a half, and as a result, the cost of production of Bitcoin doubles.

After the next halving, the cost of producing Bitcoin is calculated to reach $40,000 per Bitcoin. Historically, the production cost has acted as a strong support for the BTC price.

According to NiceHash, the next Bitcoin halving is approximately 302 days away.

Pause in Interest Rate Hikes

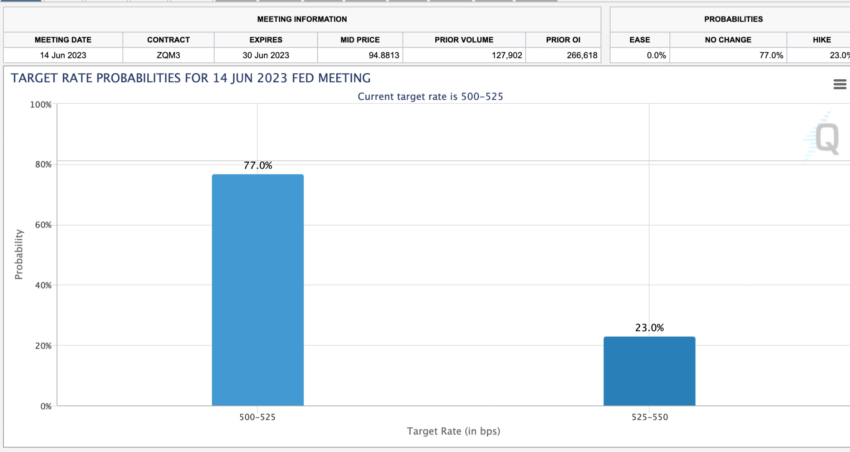

Since last year, the Federal Reserve (Fed) has aggressively increased interest rate to 5.25%, the highest in the past 16 years. The next Federal Open Market Committee (FOMC) meeting is scheduled for June 14th.

JPMorgan CEO Jamie Dimon predicts a pause in interest rate hikes. But, he expects harsher impacts in the market and advises people to prepare for it. In a Bloomberg interview, Dimon said:

“My simple view is that they’re right to pause at this point. Take a pause, but I do think it’s possible that they’re going to have to raise a little bit more, that inflation is kind of stickier.”

According to the CME Group, there is a 77% probability of a pause in interest rate hikes. In contrast, there is a 23% probability of yet another 25 basis point hike.

Got something to say about JPMorgan Bitcoin or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link