[ad_1]

I was one of the 18,000 people to enter the Grand Palais Éphémère, a huge domed exhibition hall facing the Eiffel Tower, for NFT Paris three weeks ago. The event has stuck with me more than most crypto conferences do—and I attend a lot of crypto conferences.

First off, I was blown away by the energy, positivity, and seriousness of the attendees, panel chats, and art displays. I was struck by how many global consumer and luxury brands were on hand—Adidas, Salesforce, Volkswagen, Panerai, Warner Bros, LVMH, L’Oréal, and Chanel, to name just a few—and by the fact that these brands were now pointing to actual NFT activations they’ve launched, rather than speaking in vague platitudes, pretending to be interested in Web3.

It was impossible to walk away from the conference believing crypto is dead.

But that was in France. Back in the United States, I returned home to more headlines about regulatory crackdowns, lawsuits, and fines against crypto companies.

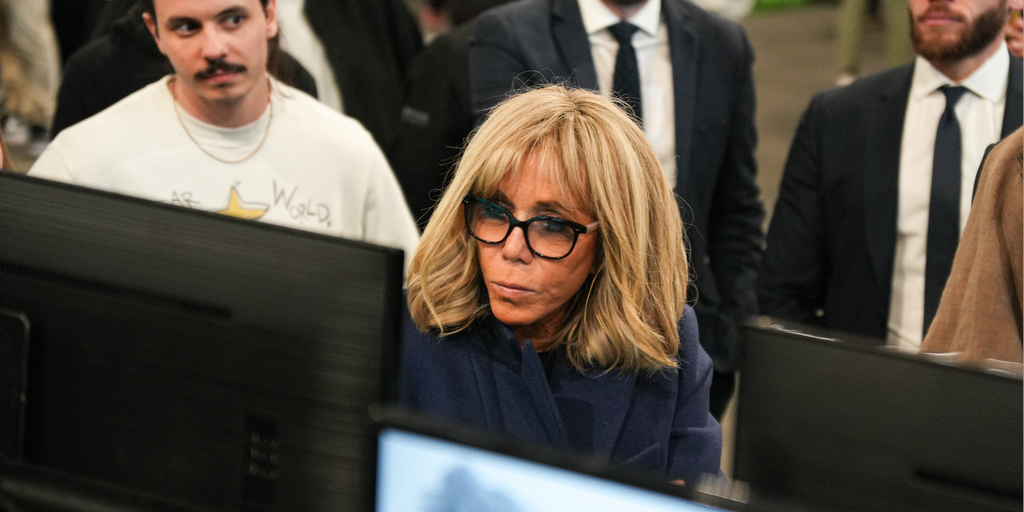

On the first day of NFT Paris, Brigitte Macron, the “première dame” of France, showed up for a surprise visit and spent time walking the floor. There was a palpable current of excitement when people started hearing she was there. And she wasn’t the only French official to drop by: Minister of Culture Rima Abdul Malak and Minister of Digital Transition Jean-Noël Barrot also made appearances.

President Emmanuel Macron said last April that Web3 is an “opportunity not to be missed” for France.

Brigitte Macron even took a seat at the Rocket Factory, where attendees could answer a couple fun questions and receive a laminated “planet holder” ID card that could be minted as an NFT later on from home. She went through the steps with the artist Tom Sachs, and later followed through and minted her NFT. (Or someone from her team did.)

Can you imagine Dr. Jill Biden attending a crypto conference in the U.S. and saying positive things? It wouldn’t happen—not in the current environment.

Every week, the SEC fines another crypto project that launched a token (many of them years ago in the ICO era), even as SEC Chair Gary Gensler continues to avoid articulating what he believes makes a token a security and why. Instead, he has added staking and lending products to the list of securities.

The agency’s $30 million fine against Kraken for its staking service is only the latest head-scratching salvo—one that had an SEC commissioner publicly questioning Gensler again.

Meanwhile, the SEC’s refusal to approve a U.S. ETF tied to the price of Bitcoin (even after approving ETFs tied to Bitcoin futures back in October 2021) is so weak that a D.C. appeals judge questioned the SEC’s logic, saying it hasn’t given enough evidence for its rejection of a Grayscale application and hasn’t explained what it sees as the difference between Bitcoin futures and the spot price of Bitcoin.

The meltdown of three U.S. banks in the past two weeks—two of which (Silvergate and Signature) were explicitly crypto banks, the other (Silicon Valley Bank) a “tech bank” whose clients included some notable crypto companies—is yet another body blow to the crypto industry. Sure, coins went up after the Feds promised to backstop deposits, but the two crypto-friendly banks just got taken off the board, which is in no way good news.

Former Massachusetts congressman Barney Frank said Signature Bank was shut down to send an “anti-crypto message,” and Reuters reported that prospective buyers of Signature are being told they must give up the bank’s crypto business, all of which sounds plausible given recent history. Regulators have denied the claims.

Of course, regulatory agencies don’t make the law, just enforce it. U.S. lawmakers are setting the nationwide narrative with their continued severe rhetoric about the risks of crypto investing, meanwhile ignoring the benefits of Web3 technology. (Sam Bankman-Fried made all of this much worse, obviously.)

The U.S. is utterly blowing it on crypto. Now the nightmare scenario is playing out: projects are leaving America to focus on Europe and other countries where they are being (comparatively) more warmly welcomed.

Coinbase, the largest publicly traded U.S. exchange, sees the writing on the wall: it is speeding up its plans for international expansion.

The current regulatory regime has left crypto executives, entrepreneurs, engineers, and investors “pulling threads out of speeches that are made by one or more commissioners, looking to media interviews that one or more commissioners or other SEC officials have given that suggest that all assets are securities,” Coinbase chief legal officer Paul Grewal said on our latest gm podcast.

Grasping at straws, reading tea leaves, trying to build businesses while fearing a Wells Notice at any moment. As Grewal asks, “Is this the best we can do?”

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link