3 Reasons Crypto Prices are Rising Today – New Bull Market Starting?

[ad_1]

Financial markets have been engulfed with fear in recent days, as fears that a tumultoous sequence of banking crises could become a contagion in the sector.

It all started with the closure of Silvergate Bank’s SEN payment network (key backend crypto industry infrastructure) following a run on deposits back in November.

This was quickly followed by the implosion of Silicon Valley Bank – the 16th largest bank in America – and a bastion of start-up capital and VC funding.

This too was driven by a run on deposits, after gruesome details emerged surrounding the performance of SVB’s bond portfolio in face of high interest rates.

Representing the biggest banking collapse since 2008, concerns around the potential spread of a banking contagion took hold.

US bank stocks were battered Friday, with some stocks down as much as -35%.

And this damage continues to spread today, with several US bank stocks seeing trading halted.

The S&P500 went negative year to day this morning – as the Dow Jones and NASDAQ took a hammering.

Meanwhile, Bitcoin (BTC) has surprised markets – with an encouraging bounce back above $20,000 being described as a ‘cyprus moment‘ as investors race to find safer havens for capital outside of the fractional reserve banking system.

Here are three reasons that help to explain why crypto prices are soaring despite the banking chaos this week.

1. Circle Puts SVB Fears To Bed

The Federal Deposit Insurance Corporation (FDIC) began selling SVB assets to repay up to 50% of deposits to SVB clients today,

This comes as a substantial relief to the legions of USDC holders that held with despair as USDC depegged over the past few days.

The depeg came after a tweet from Circle revealed their exposure to the Silicon Valley Bank crisis.

As investors flocked to move their capital out of USDC, the value dropped as low as $0.87 – sending the industry into temporary disarray.

However, over the weekend USDC has moved to repeg, having climbed back to around $0.99.

The effort to repeg has seen significant support from Coinbase, which moved to re-establish 1:1 USDC:USD trading this afternoon – although fiat USD will remain unconverted by default.

On Sunday, Circle CEO Jeremy Allaire revealed the $3.3bn (8% of Circle’s holdings) held by the firm with SVB will be available today.

Overall it seems that Circle has escaped the worst of Silicon Valley Bank for now, and this has been a huge boost of reassurance to volatile crypto markets.

2. On-Chain Sentiment: The Worst of Sell-Off is Over

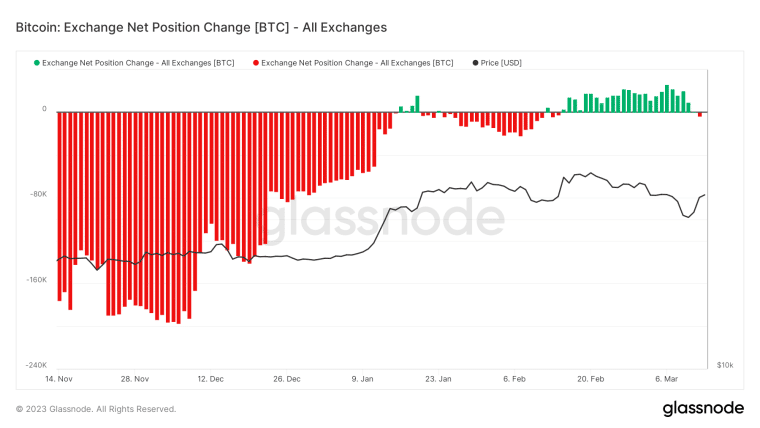

Despite serial efforts to break upwards to re-test $25,000, Bitcoin (BTC) price action has been suppressed by heavy sell pressure for almost a month – but the worst could be over for now.

Indeed, looking On-Chain, Bitcoin has faced 25-days of net inflow onto exchanges. In layman’s terms this means for 25 days more BTC has moved onto exchanges than off of them (into cold storage). This is typically a sell-off signal, as investors move their BTC off their ledgers and onto exchanges to be sold.

However, as of yesterday it appears that sell-off could now be over – as the overall exchange net position change has finally reversed to net outflow – a clear accumulation signal.

Source.

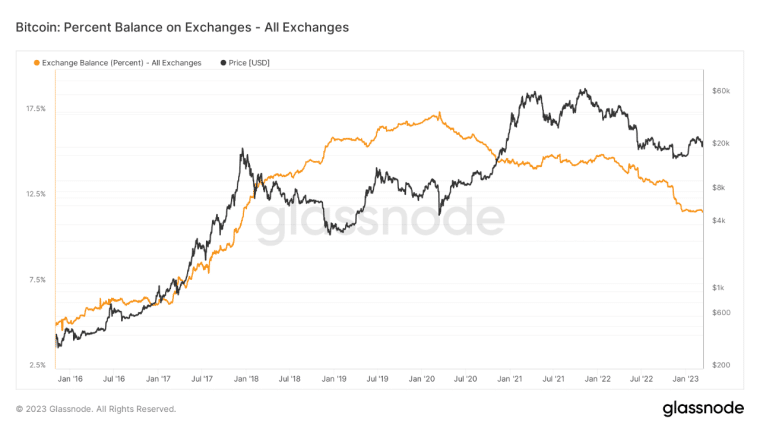

These outflows are more significant than they look – forming part of a bigger picture of Bitcoin accumulation – with exchange balance as a percentage of overall supply (11%) now at it’s lowest level since December 2017.

Source.

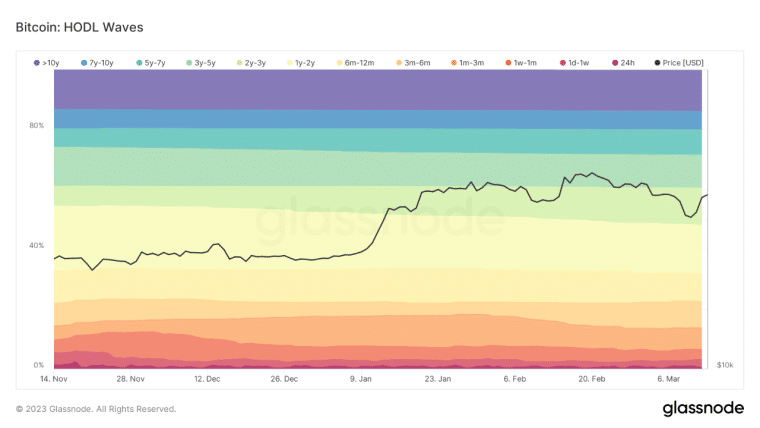

Better yet? The quick dip back below $20,000 off the back of the Silicon Valley Bank implosion appears to have shaken out remaining weak hands in the space.

A look at Bitcoin’s hold waves paints a picture of maturing supply, with recently active supply largely driving day-to-day price action.

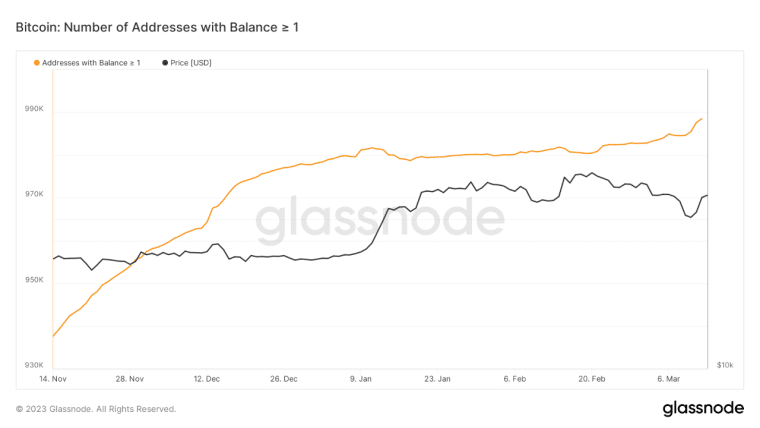

And of those strong hands? Accumulation is in full-swing with the number of Bitcoin wallets containing >1 BTC skyrocketing towards 1 million ‘wholecoiner’ addresses.

Source.

Overall, On-Chain sentiment depicts an end to the sell-off period as markets shift towards accumulation positioning – especially amongst longer-term holders.

An end to the sell-wall could mark the beginning of a big uptrend for Bitcoin and crypto at large.

3. The Bitcoin (BTC) Network is More Secure Than Ever

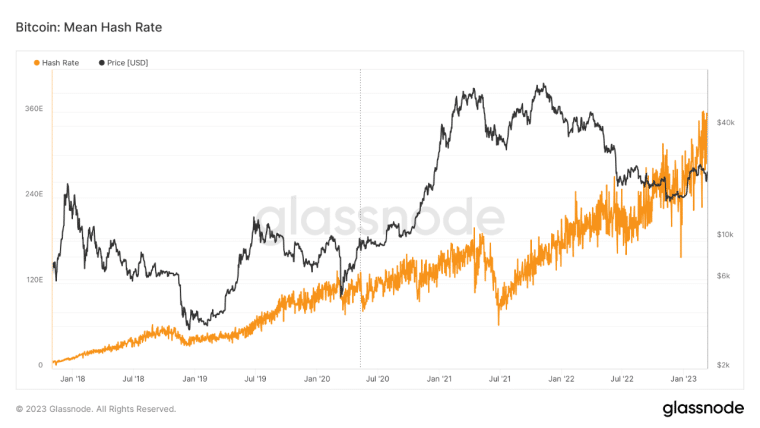

The final reason to be bullish about crypto markets this week comes from adoption of the Bitcoin SHA-256 network – which is currently the biggest it has ever been.

The SHA-256 hash rate – which measures the quantity of computing power directed at the Bitcoin network – is the highest it has ever been.

Source.

This is bullish for a number of reasons – first and foremost, there has never been so much computer power directed towards Bitcoin – meaning network adoption is the highest it has ever been. And this feeds into the second benefit of making the network more secure – a much feared 51% attack against the BTC network is less likely than ever before.

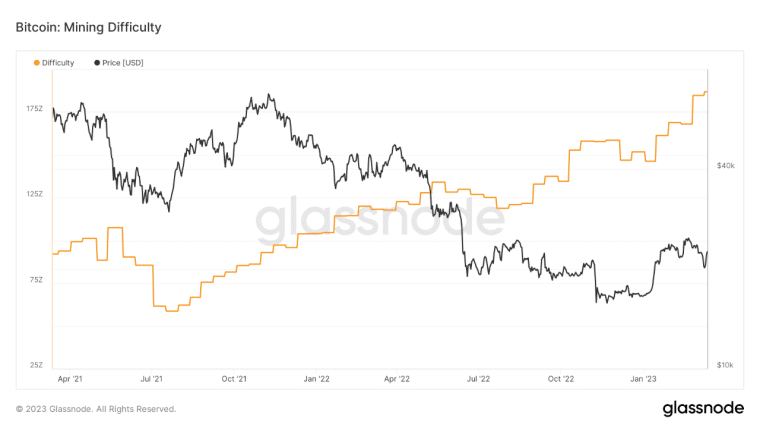

Tracking the hash rate is the difficulty rate (which measures the difficulty of mining a successful hash), the difficulty rate adjusts roughly ever two weeks to reflect the number of machines attempting to mine a BTC. This too is sat around all-time high levels – in other words – it has never been harder to mine a Bitcoin.

Source.

With the next Bitcoin halving event rapidly approaching next year, a high difficulty rate is bullish as it will start to induce the market supply shock needed for the next bull run – with more miners holding fewer coins.

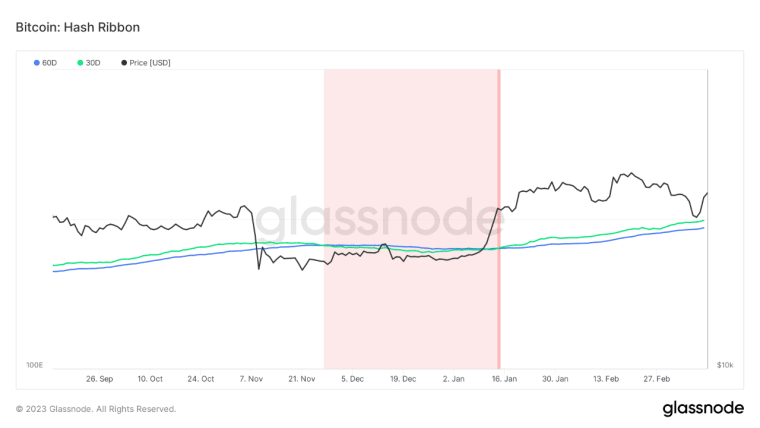

Indeed, mining can provide a great deal of insight into market bottoms. Looking at Bitcoin’s hash ribbons – which highlight periods of miner capitulation (likely BTC market bottoms) – it can be seen that recent Bitcoin price action in the New Year has carried BTC away from a serious miner capitulation zone following FTX.

Source.

This could be indicative that the worst of the 2022 Bear Market is over, and prices will lean towards the upside in the coming months approaching 2024.

[ad_2]

Source link