Bitcoin Futures Traders Predict $70,000 Price Before Halving

[ad_1]

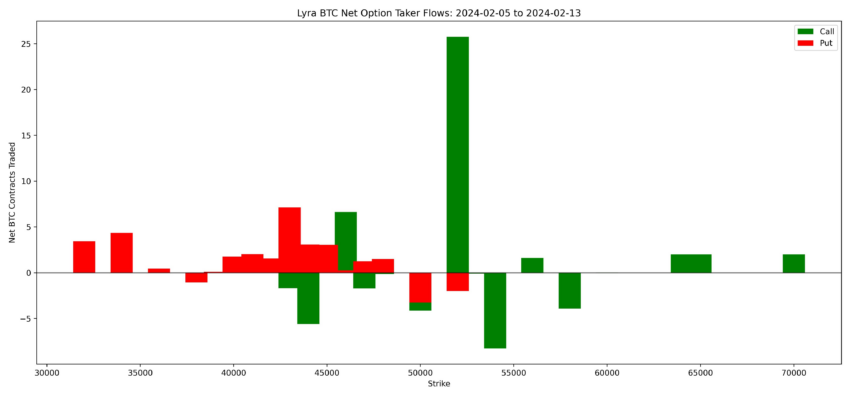

Bitcoin futures traders on the decentralized exchange Lyra predict that the asset will reach $70,000 by the end of April. The next Bitcoin halving will be in April, after which many pundits, including SkyBridge Capital’s Anthony Scaramucci, expect the price to rise, even as options and traders appear bullish.

Lyra’s traders predict with a 20% certainty that the price of BTC will rise to a new all-time high of $70,000 by April 26, 2024.

Bitcoin Futures Traders Called $50,000

The prediction comes after Lyra customers predicted Bitcoin’s $50,000 rally correctly. Volumes for $52,000 call options surged last week before Bitcoin broke out. However, crypto derivatives trader Samneet Chepal has noted an increase in volume after Feb. 7, which is when Lyra introduced new incentive schemes, making causation difficult to pinpoint.

“Also interesting to see an uptick in volumes post Feb 7th which is when new Lyra incentives were announced. It’s tricky to find causation because crypto pumped during the same period but nevertheless great to see volumes picking up!,” Chepal said.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Lyra is the largest Bitcoin futures decentralized crypto exchange. It recorded around $32 million in trading volume for the past 24 hours, an increase of 134% for the past seven days.

Higher Bitcoin Price Forecasts Widespread

Lyra traders’ sentiments coincide with a rise in open interest in Bitcoin futures contracts on centralized exchanges, suggesting speculation in Bitcoin’s future price is a market-wide trend. Open interest in futures rose to $23 billion earlier this week, while BeInCrypto reported around 15,766 calls at $50,000 with a notional value of $822 million earlier today.

The next bullish event for Bitcoin is the 2024 halving that reduces the number of coins released per mined Bitcoin transaction block. Crypto market participants have weighed in on the price of Bitcoin after this event. Grayscale Investments predicts that Bitcoin’s increase around this halving cycle will be driven by a mix of the recent flows into Bitcoin exchange-traded funds (ETFs) and heightened on-chain activity.

Speaking on Bloomberg Television earlier today, the CEO of alternative investment firm SkyBridge Capital, Anthony Scaramucci, said he expects BTC to reach $170,000 in 18 months after the Bitcoin halving. According to his statement in an earlier podcast, Bitcoin has quadrupled its pre-halving price in the past 14 years, and he expects that to continue.

Read more: Best Crypto Derivative Exchanges in 2023

“There’s a technical analysis that you can do over the past 14 years. The price at the time of the halving if you multiply that by four, that’s typically where Bitcoin has run to in that cycle. You guys are seeing that the network is only producing 900 coins a day and you know, you’ve got 12 times the demand of that right now, which is why you’re seeing a price squeeze to the upside,” Scaramucci said.

BeInCrypto reached out to the CME Group, a traditional Bitcoin futures platform, for comment but had yet to hear back at press time.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link