Bitcoin Price Prediction as BTC Spikes Up 0.2% – Is the Sell Off Over?

[ad_1]

On Sunday, Bitcoin price is currently trading at $30,325, showing a slight increase in price.

This upward movement comes as new Lightning Labs tools enable artificial intelligence (AI) to facilitate Bitcoin transactions, further advancing technology integration and digital currencies.

Additionally, the co-founder of Volatility Shares has announced the development of a Bitcoin Spot ETF, which has the potential to open new doors for investors looking to participate in the cryptocurrency market.

These recent developments raise questions about the ongoing sell-off and whether the market is beginning to stabilize.

Lightning Labs’ New Tools Enable Integration of AI with Bitcoin

A new set of developer tools from Lightning Labs, a prominent organization working on the Lightning Network for Bitcoin, has enabled the integration of Bitcoin with AI programmers and Large Language Models (LLMs) like ChatGPT.

According to a recent announcement by Lightning Labs, the Lightning Network will now allow Large Language Models (LLMs) such as ChatGPT to store, receive, and transmit Bitcoin.

This integration opens up new possibilities and expands the use-cases for Bitcoin and AI technology.

The popular Langchain AI software library will be made accessible to Bitcoin and the Lightning Network through the L402 standard, as stated by the programmers at Lightning Labs.

This expansion creates a more open AI infrastructure and further enhances the potential applications of Bitcoin and AI.

In recent months, artificial intelligence has gained significant attention worldwide, surpassing the previous investment craze focused on cryptocurrencies.

Former BitMex CEO, Arthur Hayes, has even predicted that “AI will choose Bitcoin as its native currency.”

These optimistic predictions regarding the convergence of Bitcoin and AI could be attributed to the rising prices of Bitcoin, fueling further interest and exploration in this area.

Bitcoin Spot ETF Co-Founder of Volatility Shares Sets Stage for New Investment Opportunities

The surge in the price of Bitcoin fueled by the application of an exchange-traded fund (ETF) for spot markets by financial giant BlackRock continues to gain momentum.

BlackRock’s achievement may signify the beginning of a new phase of institutional investment in Bitcoin, attracting more investors if other filers are encouraged to follow suit.

Justin Young, the co-founder, and president of Volatility Shares, expressed in an interview that investors seeking exposure to Bitcoin are actively searching for the “easiest and most regulated way” to invest in it.

He believes that a spot ETF could be the optimal method to achieve this.

The approval of a regulated spot ETF in Bitcoin, according to Young, could help “dampen” volatility and attract more investors who seek transparency in financial instruments.

Young emphasized that the main advantage of having a spot ETF and market is the potential for greater stability and reduced unfavorable volatility, addressing concerns raised by the Securities and Exchange Commission (SEC).

These supportive comments from Young have contributed to the rise in Bitcoin’s value.

Bitcoin Price Prediction

Bitcoin is currently experiencing a lack of volatility, with its trading range displaying choppy movements.

Taking a broader perspective on the daily timeframe, Bitcoin is consolidating within a narrow range, with resistance identified around $31,400 and support located approximately at $29,600.

A decisive close above the $29,600 level holds the potential to trigger a bullish move for Bitcoin.

On the flip side, if there is a clear break below $29,600, Bitcoin may find support around $28,450, and potentially even lower towards $27,450.

In terms of upward movement, surpassing the $31,350 level would set the stage for the next significant target at around $32,500.

Hence, it is recommended to closely monitor the $29,600 level as a pivotal point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the latest developments in initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our meticulously curated collection of the top 15 digittal assets to watch in 2023.

This thoughtfully compiled list has been crafted by industry experts from Industry Talk and Cryptonews, guaranteeing professional recommendations and valuable insights.

Stay ahead of the competition and uncover the potential of these cryptocurrencies as you navigate the dynamic landscape of digital assets.

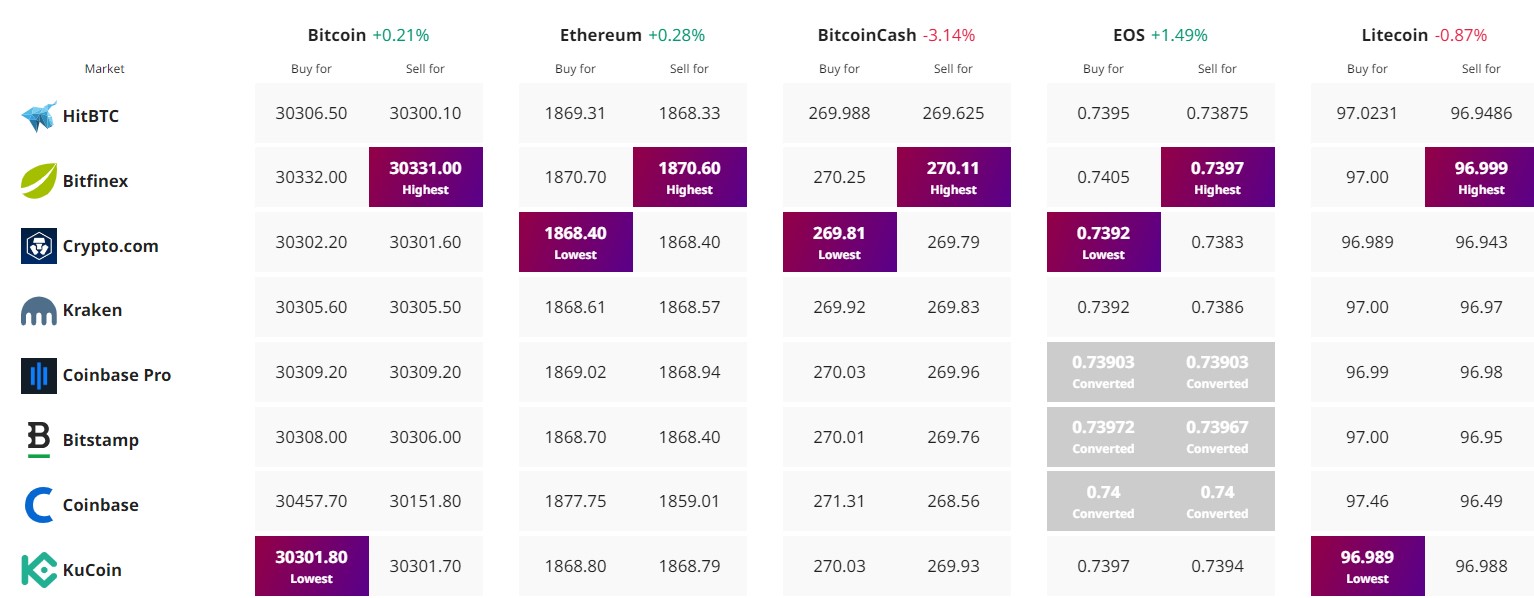

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

Source link