Openai’s GPT-4 Launch Sparks Surge in AI-Centric Crypto Assets – Altcoins Bitcoin News

[ad_1]

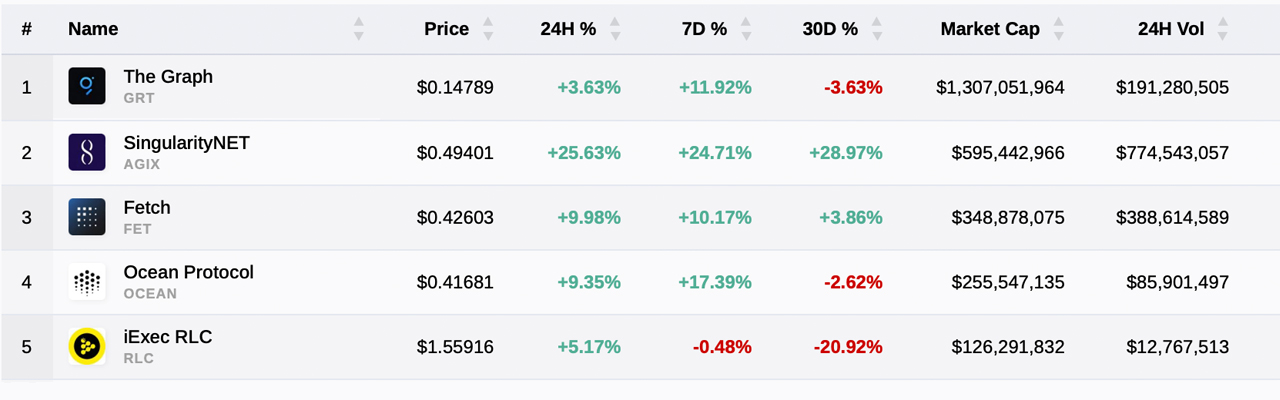

Following Openai’s release of GPT-4, a deep learning and artificial intelligence product, crypto assets focused on AI have spiked in value. The AGIX token of the Singularitynet project has risen 25.63% in the last 24 hours. Over the last seven days, four out of the top five AI-centric digital currencies have seen double-digit gains against the U.S. dollar.

An Overview of AI-Centric Crypto Asset Market Moves After GPT-4 Release

On March 14, 2023, Openai launched the next iteration of deep learning and artificial intelligence (AI) with the release of GPT-4, otherwise known as Chat GPT-4. Openai detailed on Tuesday that the new product is a “milestone” as it accepts images and text inputs and emits text outputs.

GPT-4 has also passed various professional and academic benchmarks better than the GPT-3.5 version. Furthermore, on Tuesday, it was shown that GPT-4 was able to review an Ethereum smart contract and identify specific bugs and vulnerabilities.

“I dumped a live Ethereum contract into GPT-4,” Coinbase Director Conor Grogan explained on Tuesday. “In an instant, it highlighted a number of security vulnerabilities and pointed out surface areas where the contract could be exploited. It then verified a specific way I could exploit the contract.”

Grogan also mentioned how the smart contract was exploited in 2018 and GPT-4 was able to identify the exploits used. Since the release of Openai’s GPT-4, AI-centric tokens are reaping the benefits of the product’s hype.

Currently, market statistics from cryptoslate.com indicate that 74 listed crypto assets associated with artificial intelligence concepts are valued at $3.9 billion. Nine out of the top ten AI-crypto assets are up between 0.6% and 25.63% over the last 24 hours.

Singularitynet (AGIX) has jumped 25.63% over the day and 28.97% higher over the last month. Graph (GRT) increased 3.63% over the past day and 11.92% this week. Fetch.ai (FET) is up 9.98% over the last 24 hours and 10.17% for the week. Moreover, ocean protocol (OCEAN) has risen 9.35% today and 17.39% during the past seven days.

While the fifth-largest AI-focused cryptocurrency is up 5.17% over the last day, iexec rlc (RLC) dropped 20.92% in value against the dollar this month. It is also the only AI-centric crypto in the top five that has seen a decline this week. The top four, GRT, AGIX, FET, and OCEAN, have claimed double-digit gains over the seven-day period.

Other notable AI-focused crypto asset gainers this week include cortex (CTXC) up 24.96% and singularitydao (SDAO), which jumped 18.54% higher over the last seven days. A notable loser this week was alethea liquid intelligence (ALI), down 8.63% against the U.S. dollar.

What are your thoughts on the impact of artificial intelligence on the crypto market? Share your opinions in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link