These Regulatory Changes Suggest China Will Lift Its Crypto Ban

[ad_1]

In a surprising turn of events, China has begun sending signals that it might reconsider its crypto ban. Consequently, providing hope for a potentially lucrative crypto market in the future.

The current regulatory developments in Hong Kong and technological advances in mainland China suggest that the crypto ban might finally be lifted.

A Brief History of China’s Crypto Ban

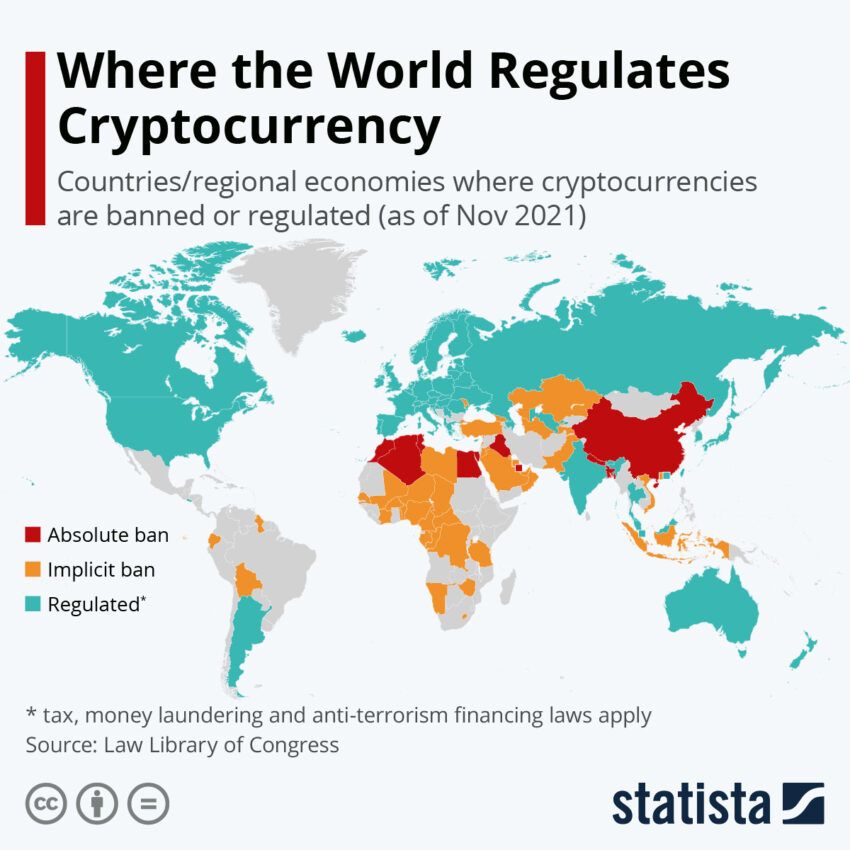

China’s relationship with the cryptocurrency industry has been tumultuous since 2013, when the country first imposed strict restrictions. The first ban came in December of that year when the People’s Bank of China (PBoC) and other financial watchdogs prohibited banks from handling transactions related to Bitcoin.

Bitcoin was deemed a “special virtual commodity.” Regulators argued that it lacked the legal backing to function as a currency. Therefore, it was seen as a potential outlet for laundering cash.

In 2017, China took further steps to prevent money from flowing out of the country illegally. In January of that year, the PBoC launched an investigation against crypto exchanges, focusing on forex management and anti-money laundering.

The findings led to the decision to ban initial coin offerings (ICOs) in September. Subsequently, the PBoC ordered capital raised via ICOs to be returned to investors.

It also banned financial institutions and non-bank payment companies from providing services that catered to token-based fundraising activities and issued a directive forcing crypto exchanges to shut down voluntarily.

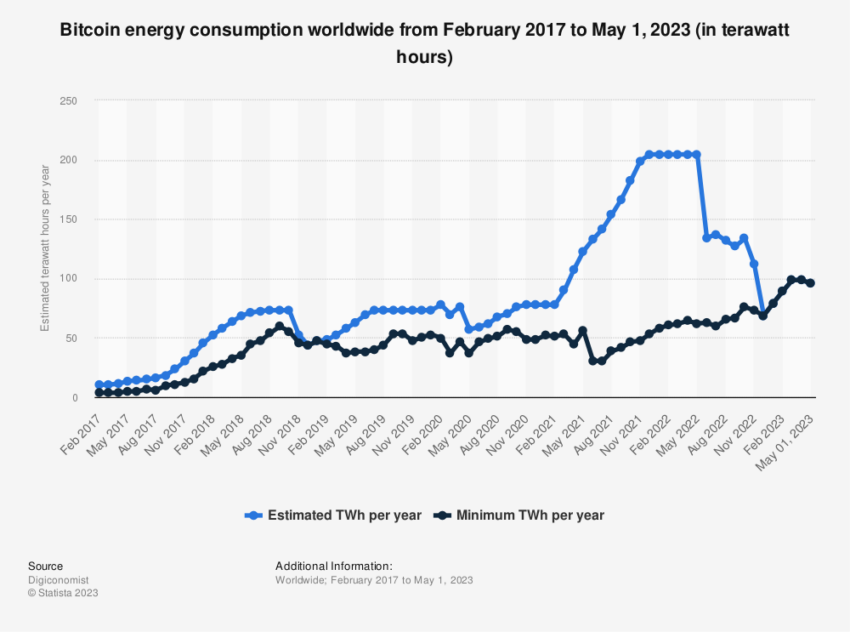

The crackdown continued in the following years, focusing on Bitcoin mining in 2019. The National Development and Reform Commission (NDRC) labeled it an “undesirable” industry due to its environmental impact.

This classification caused panic, as a significant percentage of Bitcoin mining rigs are manufactured in China, and more than half of the world’s Bitcoin mining power was located there.

In 2020, the government blocked over 100 foreign websites offering crypto exchange services. This series of restrictions culminated in 2021, when China banned crypto trading and mining altogether. It cited Bitcoin’s energy-intensive nature and threat to the country’s environmental goals.

Bitcoin miners were forced to shut down or move to other crypto-friendly countries, significantly impacting the global crypto economy.

A Green Light to Crypto Through Regulation

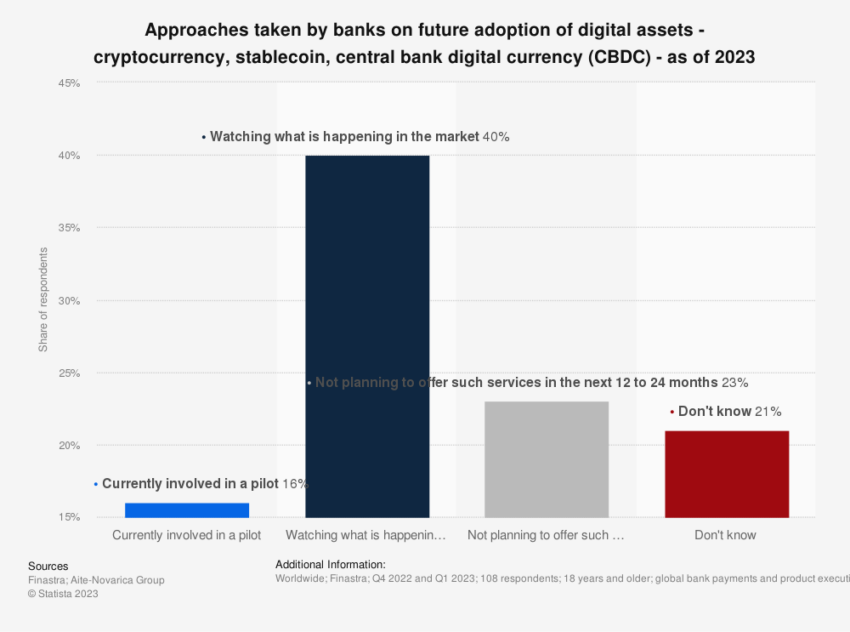

China now appears to be subtly shifting its stance on cryptocurrency. Hong Kong, a city traditionally acting as China’s sandbox, is forging ahead with new regulations suggesting that the crypto ban might finally be lifted.

Indeed, Hong Kong’s Monetary Authority (HKMA) is making substantial progress in crafting a regulatory framework for cryptos pegged to traditional financial assets, known as stablecoins.

HKMA’s announcement of a stablecoin regulatory regime by 2024 is a significant development. Especially for a region that has traditionally taken a contrary approach to mainland China, where cryptocurrency trading remains illegal.

Amid growing uncertainty and regulatory challenges in the US, the crypto community worldwide applauds Hong Kong’s steps toward policy clarification for the new asset class.

“A lot of the Chinese capital is looking for smarter, safer ways to invest [and] being in Hong Kong naturally makes more sense than anywhere else,” said Henry Liu, Chief Executive Officer at BTSE.

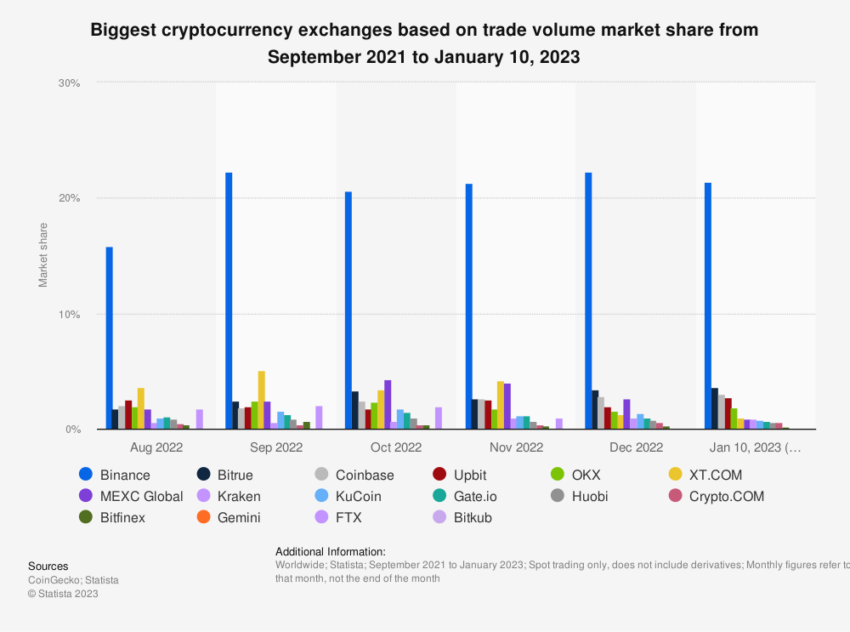

Recently, Hong Kong also introduced a new crypto regulatory regime requiring exchanges to be licensed. It aims to pave the way for retail investors to trade cryptocurrencies like Bitcoin and Ethereum. Even Hong Kong’s Legislative Council Member Johnny Ng invited crypto exchanges, including Coinbase, to apply and register in the region.

“I hereby offer an invitation to welcome all global virtual asset trading operators including Coinbase to come to HK for application of official trading platforms and further development plans,” said Ng.

With the US Securities and Exchange Commission (SEC) cracking down on crypto exchanges, this invitation indicates Hong Kong’s readiness to embrace crypto firms aiming to serve retail customers in the country.

Embracing Blockchain Technology and Web3

Furthermore, BOCI, a Chinese financial institution, recently issued CNH 200 million in digitally structured notes. It marked its first tokenized security issuance in Hong Kong.

The operation was originated by UBS and placed to its clients in Asia Pacific. Subsequently, showcasing new steps in applicable law and blockchain types. It also signified the successful introduction of regulated securities onto a public blockchain.

“We are driving the simplification of digital asset markets and products, for customers in Asia Pacific through the development of blockchain-based digital structured products… We are encouraged by the evolution of Hong Kong’s digital economy and are committed to promoting the digital transformation and innovative development of Hong Kong’s financial industry,” said Ying Wang, Deputy Chief Executive Officer at BOC.

While Hong Kong’s welcoming stance and regulatory developments are laudable, the buzz around lifting China’s crypto ban is not merely a by-product of these advances.

Beijing released a white paper on Internet 3.0 Innovation and Development in mainland China. It included blockchain technology as a key infrastructure, highlighting a potential change in China’s crypto stance.

Chaoyang District’s planned annual investment is at least 100 million yuan. The goal of supporting the construction of the Internet 3.0 industrial ecosystem further points to a more crypto-friendly future.

Changes in Policy Point to Lifting the Ban on Crypto

It is crucial to remember that lifting a crypto ban as significant as China’s will require more than just a regulatory shift.

It will entail an entire ecosystem overhaul, including improved asset custody safety measures, stringent cybersecurity standards, and enhanced due diligence practices. The Hong Kong Securities and Futures Commission’s (SFC) plans to allow licensed platforms to serve retail investors under specific guidelines indicate the meticulousness required.

These developments hint at a possible softening of China’s long-standing crypto ban. The road to a full lift remains long and complex. Still, these are promising signs for crypto enthusiasts and investors alike.

The crypto market waits in anticipation of a potential game-changer from the East. Especially now that Hong Kong and mainland China continue to refine their regulatory frameworks and embrace technological innovation.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link