These Two Events Could Put an End to Crypto

[ad_1]

Mark Yusko, a renowned hedge fund manager, gave his take on whether the FTX collapse will speed up or slow down the crypto bear market. In a recent interview, Yusko focused on two keystones of the crypto industry—GBTC and Tether.

The tragic fall of one of the largest cryptocurrency exchanges sent shockwaves across the crypto industry. The FTX collapse directly affected crypto users, investors, and related companies, especially after its contagion effect became severe.

Crypto exchanges are now under fire to provide more accountability and transparency as they try to maintain investor trust. Apart from that, the demise took a severe toll on investors’ confidence.

Meanwhile, the growing negative sentiment also put a dent in the industry. Retail confidence has encountered a significant setback, and many customers across all centralized exchanges have begun to move their funds to cold storage.

These are just a few reasons why the bear market could prevail longer than expected. Renowned analysts and executives in the space have aired their narratives amid the chaos.

Sending Shock Waves

Mark Yusko, the CEO and CIO of Morgan Creek Capital Management, appeared on the Altcoin Daily podcast. Here, the partner and founder of the asset management firm shed light on two events that he believes could seriously jeopardize crypto.

Triggered by the FTX collapse, the bear market could continue and stay longer than expected. Referencing FTX as the ‘big old storm,’ Yusko puts Sam Bankman-Fried (SBF) as the bad guy at the center of this storm. ‘Bad people do bad things and hate the players, not the game,’ Yusko said.

The FTX incident, with the added pressure of Genesis Capital (similar to bitcoin trust manager Grayscale), has the potential to seriously harm the market.

Firstly, Yusko raised concerns about the potential liquidation of the Grayscale Bitcoin Trust (GBTC).

“If GBTC has to liquidate, that would be very bad in the short run. They have a billion-dollar hole caused by the FTX and Genesis as Barry (Silbert) desperately tries to raise funds). But if he is forced to liquidate the trust and close the discount, that could be ugly.”

The Grayscale Bitcoin Trust is the largest Bitcoin fund that allows investors to gain Bitcoin exposure without actually buying BTC. Following the collapse of FTX, DCG (Grayscale’s parent firm) CEO Barry Silbert revealed that it’s been stuck with $2 billion in debt, per a CNBC report.

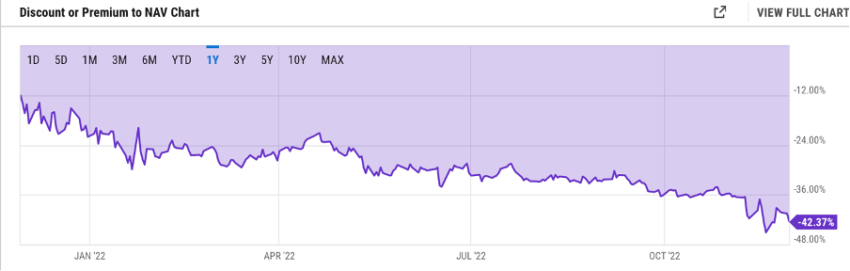

At press time, the Bitcoin-tracking investment vehicle was trading at a discount of 42.37%, according to data from YCharts. Premiums recently fell to a record discount around the time that rumors about insolvency at FTX began to leak out.

Concerns Over Tether

Yusko then moved on to his second concern, which is the top stablecoin by market cap, Tether (USDT), and its relation with FTX.

BeInCrypto reported in May about Tether’s undisclosed percentage of its assets in a boutique Bahamian bank.

Yusko, reiterating the narrative, stated:

“The fact that they are in the Bahamas along with Sam (SBF) makes me nervous. (….) if that were to seize, that’d be ugly.”

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link